revolving open end credit example

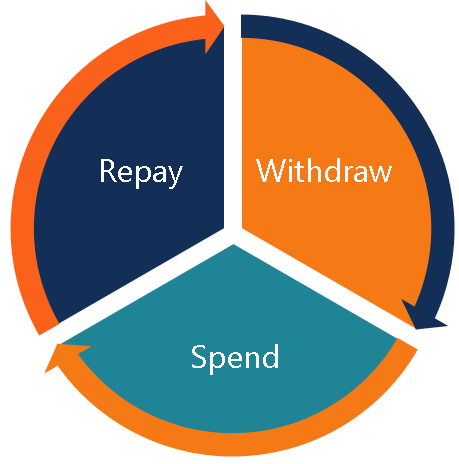

You repay any amount you used below your set limit within a specified period. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is needed.

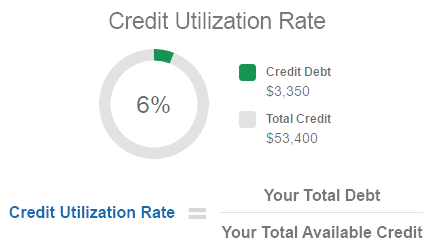

What Is A Credit Utilization Rate Experian

In contrast to more traditional loans which are given.

. How Open-End Credit Works. In other words the borrower has the right to tap into the credit made available to. The credit account can be used repeatedly provided your account stays open and all minimum payments are met.

Advantages of Open Credit. An open-end credit solves this difficulty by making credit available for usage as and when needed rather than expecting the borrower to complete repayments by a fixed date. Generally it is uneconomical and expensive for a borrower to borrow money repeatedly every two or three months and repay it fully.

Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of open-end credit. Open End Credit This is a type of credit loan paid on installments in which the total amount borrowed may. The third month you draw out 10000.

View Test Prep - Open End Credit examples from MATH 140 at Colorado Technical University. A credit card is a common example of revolving credit. With revolving credit you can make a minimum payment and carry or revolve the rest of your debt from one month or billing period to the next.

With open-end credit you receive a credit line with a limit that you can draw from as needed only paying interest on what you borrow. Personal lines of credit. An open-end loan also sometimes referred to as open-end credit is a form of borrowing that can be used up to a certain limit before it must be repaid.

For example most credit cards are issued to you without collateral attached to them. Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of open-end credit. Lets understand with an example.

For example your credit limit could increase if your credit rating improves or decrease if the lender views you as a. Once youve paid the full non-revolving credit balance the account is closed. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the borrower the freedom to use the amount of credit it needs whenever it is needed.

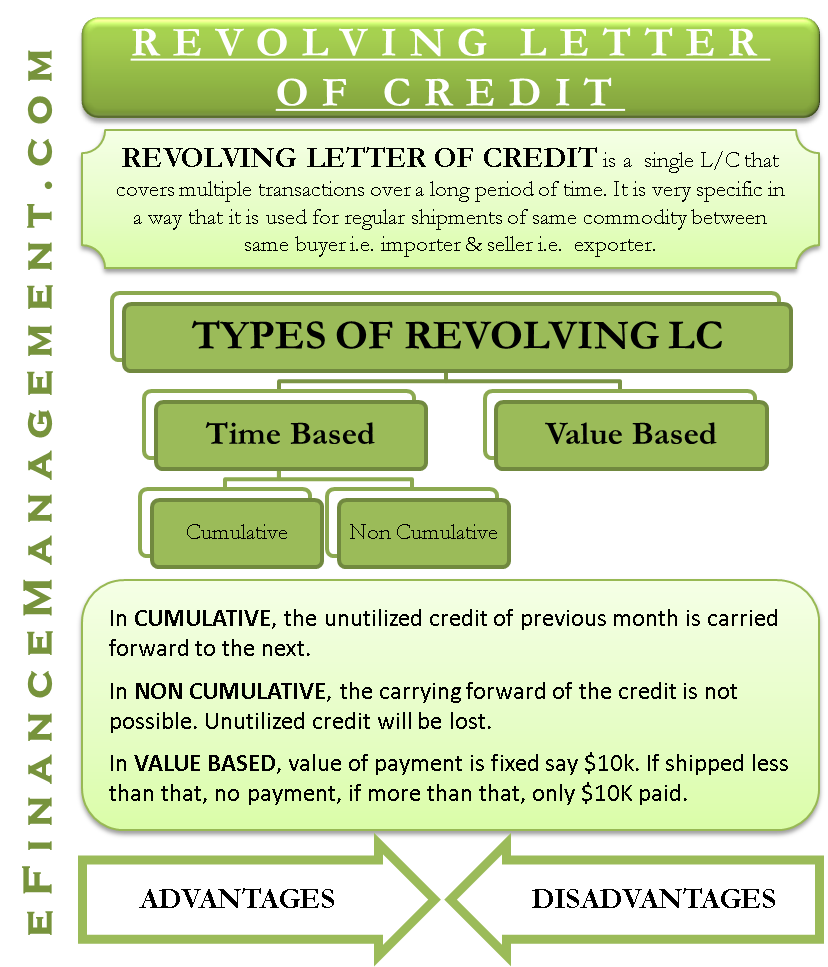

The borrower is able to withdraw indefinitely until the limit is met. In the revolving letter of credit that is based on time a specific amount payment is allowed to be drawn within a defined period of time. The first two months you dont use it and you pay nothing.

The terms can change at any time which can be a double-edged sword. However youll need to have a. Credit cards are an example of revolving open-end credit.

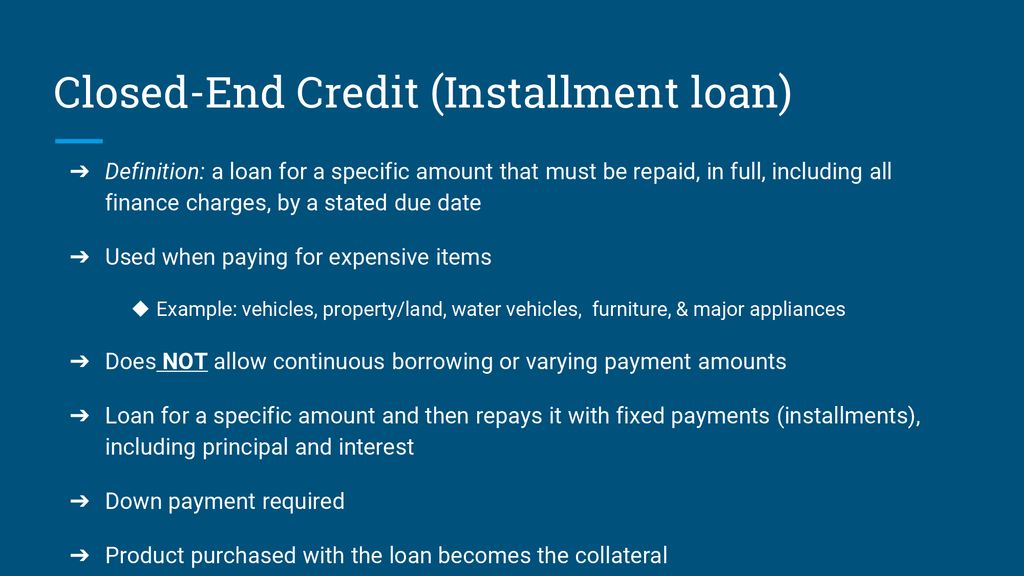

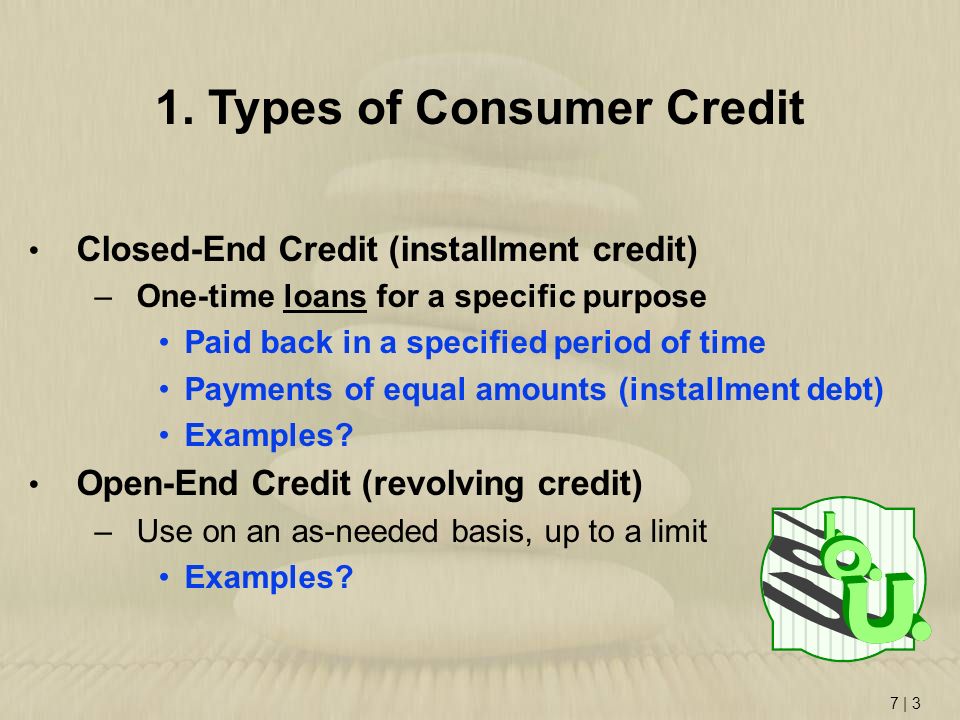

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. Will who is based in the UK. With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment.

Open-end loans are also sometimes referred to as revolving credit. Open-end credit on the other hand is revolving credit that allows you to continually access money as you make payments and only pay interest on what you use. Open-end credit also called revolving credit gives you a specific limit of credit and the ability to borrow as much or as little of that money.

In order to have good credit in the future you must have used it wisely in the past. When you carry a balance on a revolving account youll likely have to pay interest. The 3 main types of credit are revolving credit installment and open credit.

To understand it better a line of credit as used in the. The credit account can be used repeatedly provided your account stays open and all minimum payments are met. Credit enables people to purchase goods or services using borrowed money.

For a revolving line of credit also called open-end credit the customer makes purchases against the credit up to a limit set by the lender. By contrast a revolving credit facility refers to a line of credit between your business and the bank. That means that you have 15000 available to you and you start paying interest on the 10000.

Examples A credit card with revolving credit. Cho from China is a manufacturer of ball pens and is a regular supplier to Mr. An example of this would be a cellphone bill you can make phone calls send.

An open-end loan is a revolving line of credit issued by a lender or financial institution. Corporate Finance Institute. Two months later you pay back 5000 of the principal.

For example you may borrow 20000 for 60 months to buy a car. Open end credit is also known as a revolving line of credit and is arranged as a pre-approved amount of credit with no set end date or expiration date. Revolving Letter of Credit Based on Time.

A credit card is a common example of revolving credit. Some examples of non-revolving credit include auto loans mortgage loans and student loans. But you are required to pay the funds borrowed in full at the end of each period.

There are three common examples of revolving lines. Instead it permits them to use the money frequently and make timely payments before the limit is reached. Open-end credit also called revolving credit can be defined as a line of credit that gives the borrower a certain limit of credit and the ability to frequently borrow as little or as much of that money and repay any amount utilized below the set limit within a specified period.

With revolving credit you can make a minimum payment and carry or revolve the rest of your debt from one month or billing period to the next. Three types of revolving credit accounts you might recognize. Revolving open-end credit typically does not specify a maximum amount that can be borrowed.

Youll be able to access funds when and where you like up to an established. It is available in two varieties each. An open-end loan for example a credit card is a pre-approved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then paid back before payments are due.

For example lets say you get a personal LOC for 25000.

Consumer And Business Credit Ppt Video Online Download

Understanding Different Types Of Credit Nextadvisor With Time

What Is Open End Credit Experian

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

Chapter Open Ended Credit An Agreement To Lend The Borrower An Amount Up To A Stated Limit And To Allow Borrowing Up To That Limit Again Whenever Ppt Download

How Revolving Credit Works Howstuffworks

Revolving Credit Personal Credit Loans Lines Of Credit

Lesson 16 2 Types Sources Of Credit Ppt Download

Revolving Credit Vs Line Of Credit What S The Difference

Types Of Credit Definitions Examples Questions

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Credit Cards And Consumer Loans Ppt Video Online Download

What Is Open End Credit How It Works Examples Pros And Cons Cash 1 Blog News

The Top Pros And Cons Of A Revolving Credit Line Fora Financial Blog

Revolving Letter Of Credit Meaning Types With Example

Difference Between Revolving And Non Revolving Credit Facilities

How Revolving Credit Works Howstuffworks

Revolving Credit Vs Installment Credit What S The Difference

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)